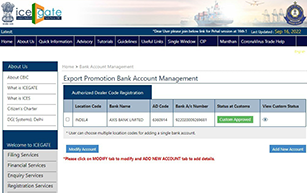

What is AD Code

An Authorized Dealer (AD) Code is a unique 14-digit number issued by a bank to businesses involved in import and export activities. It serves as a crucial identifier for these businesses, facilitating smooth customs clearance and foreign exchange transactions.

Why is an AD Code Essential?

- Customs Clearance: An AD Code is mandatory for generating a shipping bill, a vital document required for clearing goods through customs. Without it, the import or export process comes to a standstill.

- Foreign Exchange Management: AD Code links the importer or exporter to the bank, enabling hassle-free foreign exchange transactions. It helps in tracking and monitoring foreign currency movements, ensuring compliance with government regulations.

- Business Credibility: Possessing an AD Code enhances a business’s credibility in the international market. It signifies that the business is compliant with import-export regulations and is authorized to engage in foreign trade.

AD Code Registration is a must for many reasons in carrying out export business. The significant reasons are as follows:-

- Exporters who want to export goods from India must register the AD Code.

- A Shipping Bill is one of three documents that must be submitted for export customs clearance. Without an AD Code registration, you cannot produce a Shipping Bill on Icegate, Indian Customs’ electronic data exchange platform.

- AD Code Registration allows you to transfer credit to the trader’s current account directly.

- Any Government advantages you want to avail of, for example, duty rebates and exemptions, GST (Goods and Services Tax) refunds, and so on, are credited straight to your current account if you have an AD Code registered with customs.

- Registering or submitting the AD code in each & every port from where you want to export shipment is a mandatory requirement.

- When exporting goods, exporters must provide the IE Code as well as the AD Code.

- Furthermore, while receiving money from Abroad, Banks can demand the AD code of the business/individual.

get a call back from our experts

Documents Required for AD Code Registration

- Bank’s AD Code Authorization Letter: This is a crucial document issued by your bank authorizing them to issue an AD Code to your business.

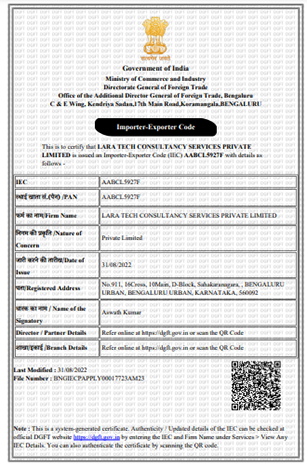

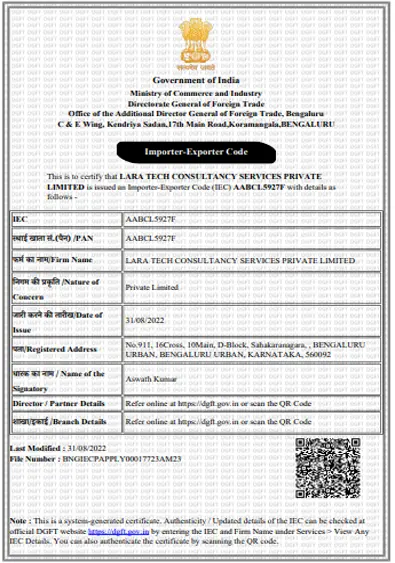

- Import Export Code (IEC) Certificate: Proof of your business’s involvement in import and export activities.

- PAN Card: The Permanent Account Number of your business.

- GST Registration Certificate: Evidence of your GST registration.

- Cancelled Cheque: For verification of bank account details.

- Business Registration Certificate: Proof of your business’s legal entity (e.g., Partnership Deed, Certificate of Incorporation).

- ID Proof of Authorized Signatory: A valid government-issued ID (Aadhaar, PAN, Passport, etc.) of the person authorized to sign on behalf of the business.

- Address Proof: Proof of your business’s registered address (e.g., electricity bill, rent agreement).

Optional Documents:

- Export House Certificate: If your business is registered as an Export House.

- Manufacturing License: If your business is involved in manufacturing.

- Customs Broker’s Letter: A letter from your customs broker requesting AD Code registration.

Our team of professionals can help you and getting the documents prepared for your application.

Registration Form

1. Name of Business : Enter the name of the business firm/company for which the AD Code required.

2. Constitution of Business : Select the type of firm, the applicant must be applied for the AD Code.

3. Description of business :Describe the nature of business for which an AD code is required.

4. Port Name :Select the port on which you want to generate AD Code

5. Earlier applied for AD Code Registration : Select yes, if you have already obtain AD Code for any port.

6. Authorised Director/Partner’s Name : Name of person who will be authorised to apply AD Code.

7. Contact Number : Enter the applicant’s correct 10-digit mobile phone number.

8. Email ID : Enter the applicant’s correct email ID.

OUR SERVICES

- IMPORT EXPORT CODE

- IEC MODIFICATION

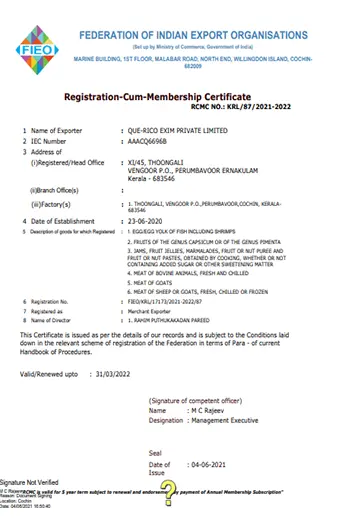

- FIEO REGISTRATION

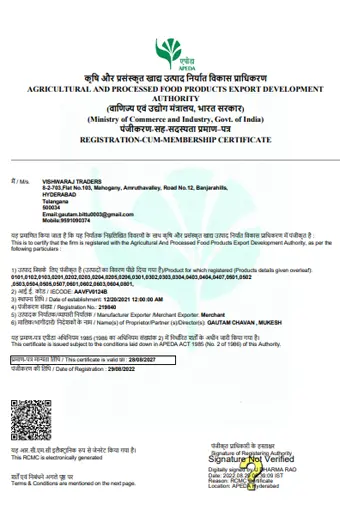

- APEDA REGISTRATION

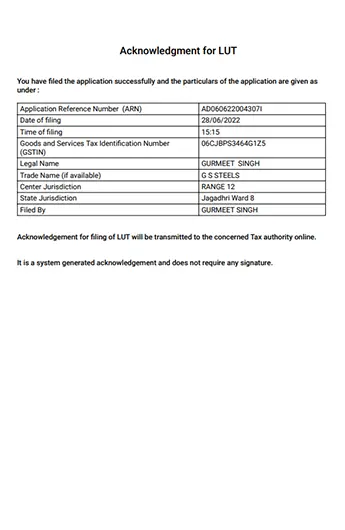

- LETTER OF UNDERTAKING

- AD CODE REGISTRATION

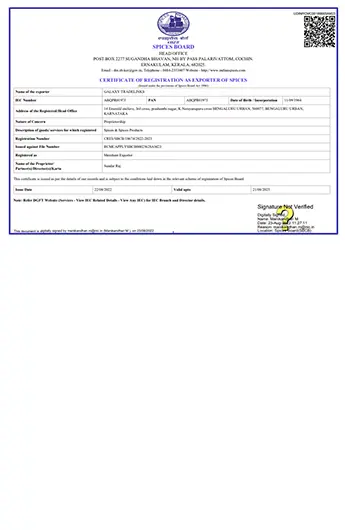

- SPICE BOARD REGISTRATION

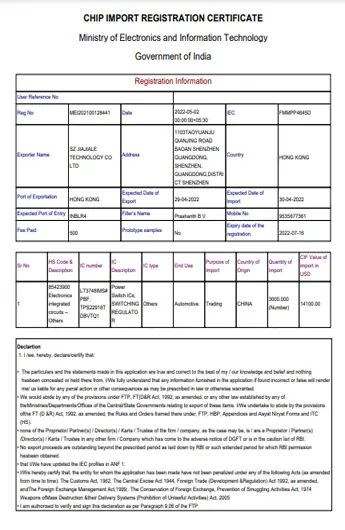

- CHIMS REGISTRATION

- US FDA Certification

- PFMS REGISTRATION

- REX CERTIFICATE

- DIGITAL SIGNATURE

- CERTIFICATE OF ORIGIN

- GST AND DRAWBACK REFUND

- ROSCTL

- RODTEP

- TECHNICAL SUPPORT RELATED ICEGATE AND DGFT PORTAL.

Import Export Code

Import Export Code, which is commonly abbreviated as IEC is the first registration required for the business entities who are dealing in Importing or exporting of goods and services from India. IEC is issued by the Directorate General of Foreign Trade (DGFT). It is a passport for import and export business.

IEC Modification

Any change or alteration made in the business details which is carrying on Import Export Code Certificate need to modify immediately while filing an IEC modification application online before DGFT.

In case of non-intimation of changes in business details with DGFT may cause cancelation of import-export code and in some cases may result in pecuniary action as well.

FIEO Registration

The Federation of Indian Export Organisations is an organisation for export promotion in India. It was jointly instituted in 1965 by the Ministry of Trade & Commerce and private trade & industry.

The FIEO acts as a representative for all the Indian entrepreneurs who are involved in the export-import market. FIEO acts as an apex body on all export promotion organizations in India. It is thus a partner of the Government of India in promoting India’s exports.

APEDA Registration

Agricultural & Processed Food Products Export Development Authority (APEDA) is a Government association founded in 1985 through an act for the Development and Growth of export of scheduled commodities. It furnishes financial assistance, information, guidelines towards the advancement of scheduled products. The products prescribed under the APEDA Act are considered as schedule products and exporters of such scheduled products are compelled to register under APEDA.

Letter of Undertaking

LUT is an acronym for the Letter of Undertaking, which is a document filed by an exporter to get a relief from payment of IGST on exports. In order to boost exports, the government has provided the option of filing LUT for exporters to do exports without payment of IGST.

Earlier, the importers & exporters had to pay IGST on the purchases of input as well as on export of goods. However, they could claim the refund of GST, but that was a really long-drawn process.

AD Code Registration

For starting an Import and Export business in India, you must have two registrations as per Government regulations. One is IEC Registration, and another one is AD Code Registration. Without these two registrations, you can not start an import-export business in India. The AD Code is required for customs clearance of your Goods.

Spice Board Registration

India is well-known for its spices. Even before India’s spirituality captured the world’s attention. It was the aroma of our spices that drew people to our nation. Moreover, India has now emerged as a worldwide participant in the spice trade. The business of exporting spices has become very beneficial for many.

CHIMS Registration

The CHIMS (Chip Import Monitoring System) Registration is a new import policy that requires importers to register with DGFT. The Registration is mandatory for importers of several products and can be obtained online.

Under CHIMS Registration, Policies that meet the ‘free’ requirements are converted to ‘free subject to obligatory registration’ under this registration. Furthermore, the Import Policy criteria for ITC (HS) 85423100, 85423900, 85423200, 85429000, and 85423300 have been amended.

US FDA Certification

If anyone wants to export the items such as Food, Drugs, Cosmetics, Color Additives, Medical Devices, Supplement, Even PPE Kit to the U.S.A, they must obtain US FDA Certification. The US FDA Certification’s main purpose is to protect and manage public health in the United State of America. The US FDA also focuses on guaranteeing the security and protection of the biologically generated product.

PFMS (Public Financial Management System)

- Core function: Manages government funds disbursement and tracking.

- Relevance: Crucial for receiving government grants, subsidies, or payments.

- Interconnections:

- GST and Drawback Refund: PFMS is often integrated with GST systems to track refunds.

- ROSCTL and RODTEP: These export promotion schemes might involve PFMS for subsidy or incentive disbursement.

REX Certificate:

REX stands for Registered Exporter. It’s a system primarily used in the European Union (EU) for certifying the origin of goods. It allows exporters to self-certify the origin of their products under specific conditions.

India doesn’t have a direct equivalent to the EU’s REX system. While there are procedures to certify the origin of goods for exports, they differ in format and process.

Digital Signature Certificate (DSC)

- A digital equivalent of a physical signature.

- Export Relevance: Mandatory for filing various export-related documents electronically on government portals like ICEGATE and DGFT.

- We Provide comprehensive DSC solutions, including application, issuance, and management.

- We offer various DSC types (Class 2, Class 3) to meet different business needs.

- We Assist in integrating DSC with various government portals for seamless operations.

ROSCTL

- Rebate of State and Central Taxes and Levies (ROSCTL): A scheme to refund state and central taxes and levies on exported products.

- Remission of Duties and Taxes on Exported Products (RoDTEP): A newer scheme replacing ROSCTL and MEIS, providing refunds for embedded taxes and levies on exported products.

- Export Relevance: Both schemes are incentives to boost exports by reducing the cost of production.

- Guide clients through the application process for ROSCTL and RODTEP incentives.

- Ensure compliance with eligibility criteria and documentation requirements.

- Maximize incentive benefits by optimizing claim calculations.

RODTEP

- Rebate of State and Central Taxes and Levies (ROSCTL): A scheme to refund state and central taxes and levies on exported products.

- Remission of Duties and Taxes on Exported Products (RoDTEP): A newer scheme replacing ROSCTL and MEIS, providing refunds for embedded taxes and levies on exported products.

- Export Relevance: Both schemes are incentives to boost exports by reducing the cost of production.

- Guide clients through the application process for ROSCTL and RODTEP incentives.

- Ensure compliance with eligibility criteria and documentation requirements.

- Maximize incentive benefits by optimizing claim calculations.

LIST OF PORTS / ICD FOR AD CODE

| Port Name and Code | |

|---|---|

| ACC Coimbatore Sriperumbudur ICD (INCJB4) | AGARTALA LCS (INAGTB) |

| AZHIKKAL PORT (INAZK1) | Agra ICD (INBLJ6) |

| Ahmedabad ACC (INAMD4) | Alang (INALA1) |

| Amingaon ICD (INAMG6) | Amritsar ACC (INATQ4) |

| Amritsar Rail Cargo (INASR2) | Ankaleshwar ICD (INAKV6) |

| Arakkanom ICD (INAJJ6) | BADDI ICD (INBDI6) |

| BAIRGANIA (INBGUB) | BALASORE CONCOR ICD (INBLE6) |

| BANBASA LCS (INBSAB) | BANKOT PORT (INBKT1) |

| BARHI ICD (INRUG6) | BHAMBOLI ICD (INGRW6) |

| BHIMNAGAR (INBNRB) | BHITAMORE (INBTMB) |

| BIRPARA (INDLOB) | Ballagharh ICD (INFBD6) |

| Bangalore ACC (INBLR4) | Banglore ICD (INWFD6) |

| Bawal ICD (INBAW6) | Bedi Port (INBED1) |

| Behrni LCS (INBNYB) | Beypore Port (INBEY1) |

| Bhavnagar Port (INBHU1) | Bhilwara ICD (INBHL6) |

| Bhiwadi ICD (INBWD6) | Bhubaneswar Air Cargo (INBBI4) |

| Bhusswal ICD (INBSL6) | Borkhedi ICD (INBOK6) |

| Butibori ICD (INNGB6) | CFS Albartoss ICD Dadri (INAPL6) |

| CFS Mulund (INMUL6) | CFS STARTRACK DADARI (INSTT6) |

| CGM DADARI (INCPL6) | CH Chennai (INMAA1) |

| CH Cochin (INCOK1) | CH Goa (INMRM1) |

| CH Kakinada (INKAK1) | CH Kandla (INIXY1) |

| CH Mangalore (INNML1) | CH Mundra (INMUN1) |

| CH Tuticorin (INTUT1) | CHAMURCHI (INCHMB) |

| CHANGRABANDHA (INCBDB) | CHAWAPAYAL ICD (INCPR6) |

| CONCOR DADARI (INDER6) | CONCOR ICD JHARSUGUDA (INJSG6) |

| CSF Nashik (INNSK6) | CUDDALORE PORT (INCDL1) |

| Calicut ACC (INCCJ4) | Chakeri Kanpur ICD (INCPC6) |

| Cheherta ICD (INASR6) | Chennai ACC (INMAA4) |

| Chettipalayam Tirpur ICD (INCHE6) | Chinchwad Pune ICD (INCCH6) |

| Cochin ACC (INCOK4) | Concor Kanakpura Jaipur ICD (INKKU6) |

| Custom House Pondicherry (INPNY1) | DABGRAM ICD (INNJP6) |

| DABHOL PORT (INDHP1) | DAPPAR ICD (INDPR6) |

| DESUR ICD (INDRU6) | DHAHANU PORT (INDHU1) |

| DHAMRA Port (INDMA1) | DHANNAD ICD (INDHA6) |

| DHARCHULA LCS (INDLAB) | DIGHI PORT (INDIG1) |

| Dahej Port (INDAH1) | Dashrath Badodra ICD (INBRC6) |

| Delhi ACC (INDEL4) | Dharmatar Port Mumbai (INDMT1) |

| Dighi ICD (INDIG6) | Durgapur ICD (INDUR6) |

| Ennor Port (INENR1) | FULBARI (INFBRB) |

| Faridabad Sec-25 ICD (INBVC6) | GALGALIA (INGALB) |

| GHOJADANGA LCS (INGJXB) | GOPALPUR PORT (INGPR1) |

| GRFL Sahnewal Ludhiana ICD (INSGF6) | GUWAHATI AIR CARGO (INGAU4) |

| Gangavaram Port (INGGV1) | Gari Harasaru ICD (INGHR6) |

| Goa ACC (INGOI4) | HTPL ICD Kilaraipur (INQRH6) |

| Hazira Port, Surat (INHZA1) | Hira Boruse Surat ICD (INHIR6) |

| Hosur ICD (INHSU6) | Hyderabad ACC (INHYD4) |

| Hyderabad ICD (INSNF6) | ICD CONCOR Dhandari Kalan Ludhiana (INLDH6) |

| Intore ACC (INIDR4) | Irugur ICD (INIGU6) |

| Irungattukottai Sriperumbudur ICD (INILP6) | JAJPUR ICD (INJJK6) |

| JAKHAU PORT (INJAK1) | JAMNAGAR AIR CARGO (INJGA4) |

| JAMSHEDPUR ICD (INIXW6) | JAYANAGAR (INJAYB) |

| JHULAGHAT LCS (INJHOB) | JNCH (INNSA1) |

| JRY Kanpur ICD (INKNU6) | |

|

Jaigarh Port Maharashtra (INJGD1) Jaipur ACC (INJAI4) Jaipur ICD (INJAI6) Jalandhar ICD (INJUC6) Janori ACC (INJNR4) Janori ICD (INJNR6) |

Jattipur ICD (INDWN6) KALINGANAGAR ICD (INSKD6) KAMARDWISA LCS (INPBLB) KANECH ICDSAHNEWAL (INSNI6) KARAIKAL SEA Port (INKRK1) KARIMGANJ LCS (INKGJ1) |

|

KELSHI PORT (INKSH1) KERN ICD MADURAI (INMDU6) KILARAIPUR ADANI ICD (INQRP6) KODINAR PORT (INKDN1) KRIBHCO Surat ICD (INKBC6) KUNAULI (INKNLB) |

Karwar Port (INKRW1) Kashipur ICD (INHPI6) Kattupalli Port (INKAT1) Khatuwas ICD (INCML6) Kheda ICD (INKHD6) Khurja ICD (INAIK6) |

|

Kolkata ACC (INCCU4) Kolkata CH (INCCU1) Kollam Port (INKUK1) Kota ICD (INKTT6) Krishnapatnam Port (INKRI1) LAUKAHA (INLKQB) |

LCS Attari Road (INATRB) LCS DARRANGA (INDRGB) LCS HILLI (INHLIB) LCS Jaigaon (INJIGB) LCS Jogbani (INJBNB) |

|

Vizag Port (INVTZ1) Waluj Aurangabad ICD (INWAL6) Wardha ICD (INCHJ6) |

concor Jodhpur ICD (INBGK6) karur ICD (INKAR6) kottayam ICD (INKYM6) Vapi ICD (INVPI6) Varanasi Air Cargo (INVNS4) Veerappandi ICD (INTHO6) |

|

Verna ICD (INMDG6) Vijaydurg Port (INVYD1) Vishakhapatnam Air Cargo (INVTZ4) |

Tuglakabad ICD (INTKD6) Tumb ICD (INSAJ6) Tuticorin ICD (INTUT6) VIRAMGAM ICD (INVGR6) VIZHINJAM PORT (INVZJ1) Vadinar Port (INVAD1) |

|

Thudiyalur ICD (INTDE6) Tikonia LCS (INTKNB) Tiruchirapalli Air Cargo (INTRZ4) Tirupur Paakiyapalayam ICD (INTUP6) Tondiapet ICD (INTVT6) Trivandrun ACC (INTRV4) |

Talegaon Pune ICD (INTLG6) Tarapur ICD (INBNG6) Thar Dry Port Jodhpur ICD (INTHA6) Thar Dry Port sanand ICD (INSAU6) Thimmapur ICD (INTMX6) Thrissur ICD (INTCR6) |

|

Sahar ACC (INBOM4) Singanallur ICD (INSLL6) Sonauli LCS (INSNLB) Sonepat ICD (INBDM6) Srinagar Air Cargo (INSXR4) TUNA PORT (INTUN1) |

SIKKA PORT (INSIK1) SINGHABAD RAILWAY STATION MALDA (INSNG2) SONABARSA (INSNBB) SRIMANTAPUR LCS (INSMPB) Sabarmati Ahmedabad ICD (INSBI6) Sachin ICD (INSAC6) |

|

Rewari ICD (INREA6) SACHANA ICD (INJKA6) SALAYA PORT GUJRAT (INSAL1) SATTVA BENGALURU ICD (INKQZ6) SEA PORT- PORT BLAIR (INIXZ1) SHED KIDDERPORE TT (INTTS1) |

RANPAR PORT Ratnagiri Maharashtra (INRNR1) REDI PORT (INRED1) REVDANDA PORT (INRVD1) Raiganj LCS (INRGJ2) Raipur ICD (INRAI6) Ratlam ICD (INRTM6) |

|

Piyala ICD (INBFR6) Porbandar Port (INPBD1) Powarkheda ICD (INPRK6) RADHIKAPUR RAILWAY STATION (INRDP2) RAJSICO Basni Jodhpur ICD (INJUX6) RANAGHAT RAILWAY STATION NADIA (INRNG2) |

Paradeep Port (INPRT1) Patli ICD (INPTL6) Patparganj ICD (INPPG6) Pimpri ICD (INPMP6) Pipavav Port (INPAV1) Pitampur ICD (ININD6) |

|

Pali Rewari ICD (INPKR6) Palwal ICD (INPWL6) Panaji Port (INPAN1) Panipat ICD (INPNP6) Panki ICD (INPNK6) Pantnagar ICD (INHDD6) |

PCCCC Bandra-Kurla Complex (INDPC4) PIPRAUN (INKJIB) PSWC Dhandari Kalan Ludhiana (INDDL6) PULICHAPALLAM ICD (INPNY6) PUNE AIR CARGO (INPNQ4) Pakwara Moradabad ICD (INMBD6) |

|

Nagpur ICD (INNGP6) Navlakhi Port (INNAV1) Okha Port (INOKH1) Old Mangalore Port (INIXE1) Old Mundra Port (INOMU1) PANITANKI NAXALBARI (INPNTB) |

Marripalaem (Leap International Ltd.) ICD (INGNR6) Modinagar ICD (INMUZ6) NAGPUR AIR CARGO (INNAG4) NAYA RAIPUR CONCOR ICD (INRML6) NCH Mumbai (INBOM1) Nagapattinam (INNPT1) |

|

Madhosingh ICD (INMBS6) Madurai Air Cargo (INIXM4) Magdalla Port (INMDA1) Malanpur ICD (INMPR6) Maliwada ICD (INMWA6) Mandideep ICD (INMDD6) |

LUCKNOW AIR CARGO (INLKO4) Loni ICD (INLON6) Lucknow Air Cargo (INLOK4) MIHAN ICD (INKPK6) MOREH LCS (INMREB) MUHURIGHAT LCS (INMHGB) |

|

LCS MAHADIPUR (INMHDB) LCS Nepalgunj Road (INNGRB) LCS Pertapole (INPTPB) LCS Raxaul (INRXLB) LCS Thoothibari (INNTVB) LOKSAN LCS (INCRXB) |